Offered by IITM Computer Education, Mathura

#ADCA #AdvancedDiploma #ComputerEducation #TallyPrime #MSOffice #AccountingCourse #ComputerCourse #JobOrientedCourse #ComputerTraining #DigitalSkills #IITMMathura #TallyWithGST #MSExcel #ComputerDiploma #ChatGPTSkills #BestComputerInstitute #SkillDevelopment #OfficeAutomation #ADCA2025 #TaxationTraining #PracticalLearning #MathuraEducation

The ADFA course is a comprehensive program designed to provide students with in-depth knowledge of financial accounting, taxation, and industry-relevant business software tools. This course empowers students with practical skills in computerized accounting systems, GST filing, Excel reporting, and office automation—essential for a successful career in finance and accounting.

Semester 1: Computer & Office Applications

Subject 1: Computer Fundamentals

· Basics of Computer Hardware & Software

· Operating Systems

· File Management & Peripheral Devices

Subject 2: MS Office Suite

· MS Word (Documentation & Formatting)

· MS Excel (Basic Formulas & Charts)

· MS PowerPoint (Presentations)

Subject 3: Internet & Communication Tools

· Internet Usage & Email

· Cyber Safety & Online Communication

· Use of ChatGPT in Office Tasks

Semester 2: Accounting Principles & Tally

Subject 4: Financial Accounting Basics

· Introduction to Accounting

· Journal, Ledger, Trial Balance

· Profit & Loss Account, Balance Sheet

Subject 5: Tally Prime with GST

· Company Creation & Ledger Management

· GST Setup and Transactions

· Inventory, Payroll, Cost Centres, Budgeting

· TDS, BRS, and Report Generation

Semester 3: Advanced Tools & Taxation

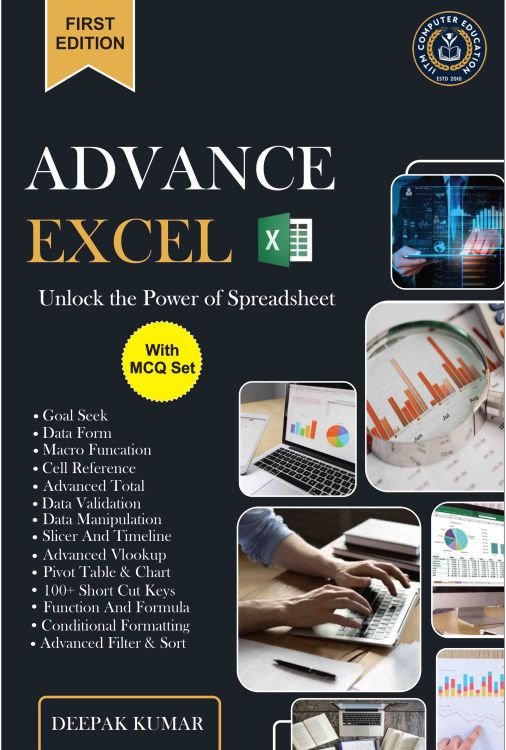

Subject 6: Advanced Excel for Accountants

· Financial Functions (PMT, NPV, IRR)

· VLOOKUP, Pivot Tables, Dashboards

· Data Validation, Conditional Formatting

· Excel Automation Basics

Subject 7: Direct & Indirect Taxation

· Overview of GST (CGST, SGST, IGST)

· GST Returns & Filing Procedures

· TDS/TCS Setup & Calculation

· Basics of Income Tax

Semester 4: Payroll, Audit & Project Work

Subject 8: Payroll Management

· Employee Data Handling

· Salary Components & Deductions

· PF, ESI Setup

· Payroll in Tally & Excel

Subject 9: Auditing & Compliance

· Introduction to Auditing

· Types of Audits

· Audit Reports & Documentation

· Legal Compliance in Accounting

Subject 10: Project & Viva

· Real-world Project on Tally/Excel

· Viva Voce based on Course Topics

· Final Assessment and Submission

Course Benefits

· Industry-Relevant Curriculum

· Practical Training on Tally, Excel & GST Filing

· Free Interview Preparation & Typing Practice

· Certification from IITM Computer Education

· Internship & Job Assistance*

1. 100% Practical Training

· Hands-on practice in Tally Prime, Excel, GST portals, and more

· Real-time accounting and tax return simulation

2. Certified and Experienced Trainers

· Learn from qualified professionals with industry experience

· Personalized guidance for every student

3. Free Career Guidance

· Resume building sessions

· One-on-one career counseling

· Personality development classes

4. Internship Opportunities

· Access to live projects and internship programs

· Work experience letter for better job placement

5. Job Placement Support

· Dedicated placement cell

· Regular job alerts via WhatsApp

· On-campus and off-campus interview drives

6. Government Exam Readiness

· NIELIT (O/A Level) support for govt. job aspirants

· Extra classes for CCC & competitive exam basics

7. Soft Skills & Interview Preparation

· Mock Interviews

· Group Discussions

· Email Writing & Communication Practice

8. Free Study Material & Notes

· Printed notes and PDFs for every subject

· GST and Excel cheat sheets for quick revision

9. Certification with QR Code Verification

· Industry-recognized certificate from IITM

· QR code enabled for online verification by employers

10. Flexible Batch Timings

· Morning, Evening, and Weekend Batches

· Suitable for students, working professionals, and homemakers

11. Bonus Learning Tools

· Free Typing Practice Lab Access

· Free access to updated GST portal mock site

· Use of ChatGPT for daily office automation tasks

ADCA – Advanced Diploma in Computer Applications

A complete professional course designed to provide strong practical skills in computers, office tools, accounting, taxation, and modern digital technologies.

10th or 12th Pass (Any Stream)

No prior computer knowledge required. Suitable for beginners and job seekers.

Duration: 12 Months (1 Year)

Practical + Theory + Project Work

Course Code : D001

Course Code : S-09

Course Code : S-003

Course Code : M-OO2

Course Code : M-001

Course Code : S-01

Course Code : S-02

Course Code : S-03

Course Code : S-04

Course Code : S-08

Course Code : M-001

Course Code : M-OO2

Course Code : S-01

Course Code : M-003

Course Code : S-01

Course Code : S-04

Course Code : C-11

Course Code : D-02

Course Code : C-11

Course Code : M-003

Course Code : D-02

Course Code : D-02

Course Code : S-12

Course Code : S-04

Course Code : C-11

Course Code : M-001

Course Code : M-003

Course Code : D-02

Course Code : S-C18

Course Code : D-11

Course Code : S-DEO

Course Code : S-C-09

Course Code : S-C-09

Course Code : DGD01

Course Code : S-C021

Course Code : S-C021

Course Code : S-01

Course Code : S-12

Course Code : C-11

Course Code : S-04

Course Code : M-001

Course Code : M-003

Course Code : D-02

Course Code : S-12

Course Code : S-C18

Course Code : S-DEO

Course Code : S-C-09

Course Code : DGD01

Course Code : S-C021

Course Code : S-D14

Course Code : S-D15

Course Code : S-D15

Course Code : S-D15

Course Code : DGD01

Course Code : D001

Course Code : D001

Course Code : S-C-26

Course Code : M-OO2

Course Code : M-AD-02

Course Code : M-AD-02

Course Code : M-AD-02

Course Code : M-AD-02

Course Code : M-AD-02

Course Code : C25

Course Code : S-27

Course Code : S-27

Course Code : C25

Course Code : S-27

Course Code : C25

Course Code : M-001

Course Code : M-003

Course Code : D-02

Course Code : M-AD-02

Course Code : C25

Course Code : S-27

Course Code : S-C18

Course Code : S-DEO

Course Code : S-C021

Course Code : S-01

Course Code : C-11

Course Code : S-D15

Course Code : DGD01

Course Code : S-04

Course Code : S-C021

Course Code : S-C18

Course Code : S-DEO

Course Code : S-C27

Course Code : S-D15